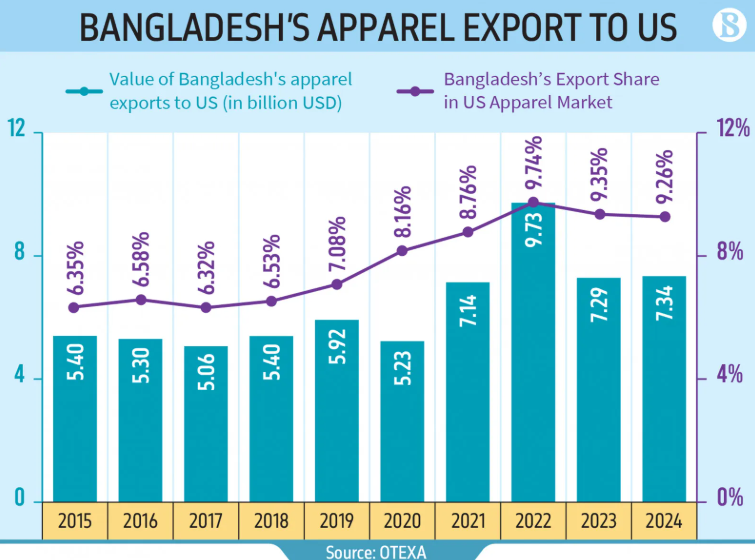

In 2024, Bangladesh’s readymade garment (RMG) exports to the United States experienced a modest increase of 0.75%, totaling $7.34 billion, according to data from the U.S. Department of Commerce’s Office of Textiles and Apparel (OTEXA). This growth follows a 25% decline in 2023, when exports fell to $7.29 billion from a peak of $9.73 billion in 2022.

Market Share and Export Volume

Despite the increase in export value, Bangladesh’s share of the U.S. apparel market slightly declined to 9.26% in 2024 from 9.37% in 2023. In terms of volume, RMG shipments rose by 4.89%, reaching 2.37 billion square meters compared to 2.26 billion in the previous year.

Fluctuations Throughout the Year

The year began with a significant 36.73% drop in January exports to $547.96 million. Further declines were recorded in March through July, with August showing a marginal dip of 0.20%. However, exports rebounded in the second half of the year, starting in September. November saw the highest single-month increase at 42.14%, followed by a 16.52% rise in December, leading to a positive overall outcome for the year.

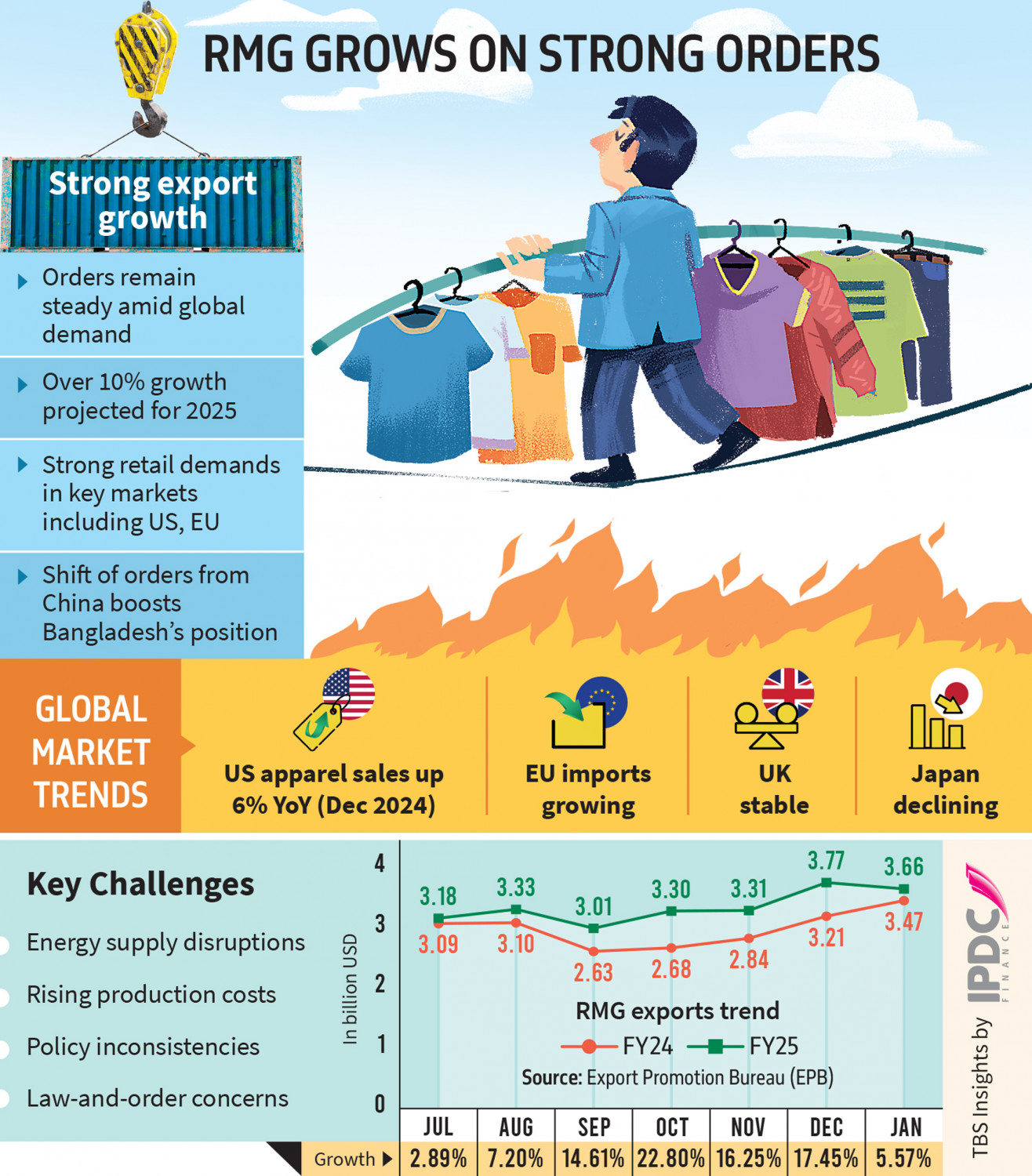

Challenges and Industry Outlook

Faruque Hassan, former president of the Bangladesh Garment Manufacturers and Exporters Association, noted that despite challenges such as gas and electricity shortages, labor unrest, and political transitions, the industry achieved modest growth. He expressed optimism for 2025, citing rising demand from Western markets, easing inflation, and lower interest rates. Hassan also highlighted Bangladesh’s potential to benefit from the China-U.S. trade tensions, provided internal factors like political stability improve.

Abdullah Hil Rakib, managing director of Team Group, emphasized the opportunity for Bangladesh to expand in the U.S. market as businesses shift from China. He pointed out that the U.S. government’s plan to impose a 10% import duty on Chinese goods could further benefit Bangladesh. However, Rakib criticized the lack of government support, urging a review of policies based on International Monetary Fund recommendations to prevent industry stagnation.

Decade-Long Export Trends

Over the past decade, Bangladesh’s apparel exports to the U.S. have grown by 35.87% in value and 26.62% in volume, reaching $7.34 billion in 2024. Exports fluctuated during this period, with a notable decline to $5.23 billion in 2020, followed by a strong rebound in 2021, rising 36% to $7.14 billion. The peak occurred in 2022, with exports hitting $9.73 billion, before dipping in 2023 due to global economic factors.

Bangladesh remains the third-largest apparel exporter to the U.S., with a 9.26% market share, while China and Vietnam hold 20.83% and 18.90% shares, respectively. Total U.S. apparel imports reached $79.26 billion in 2024, a 1.71% increase from the previous year.

In summary, Bangladesh’s RMG sector has demonstrated resilience amid global challenges, achieving slight growth in exports to the U.S. in 2024. Strategic positioning and adaptability will be crucial for sustaining and enhancing this growth in the coming years.

Source:

https://www.thedailystar.net/business/news/rmg-exports-us-grow-after-gap-two-years-3819216

https://www.tbsnews.net/economy/rmg/apparel-exports-us-grow-slightly-734b-2024-1064131