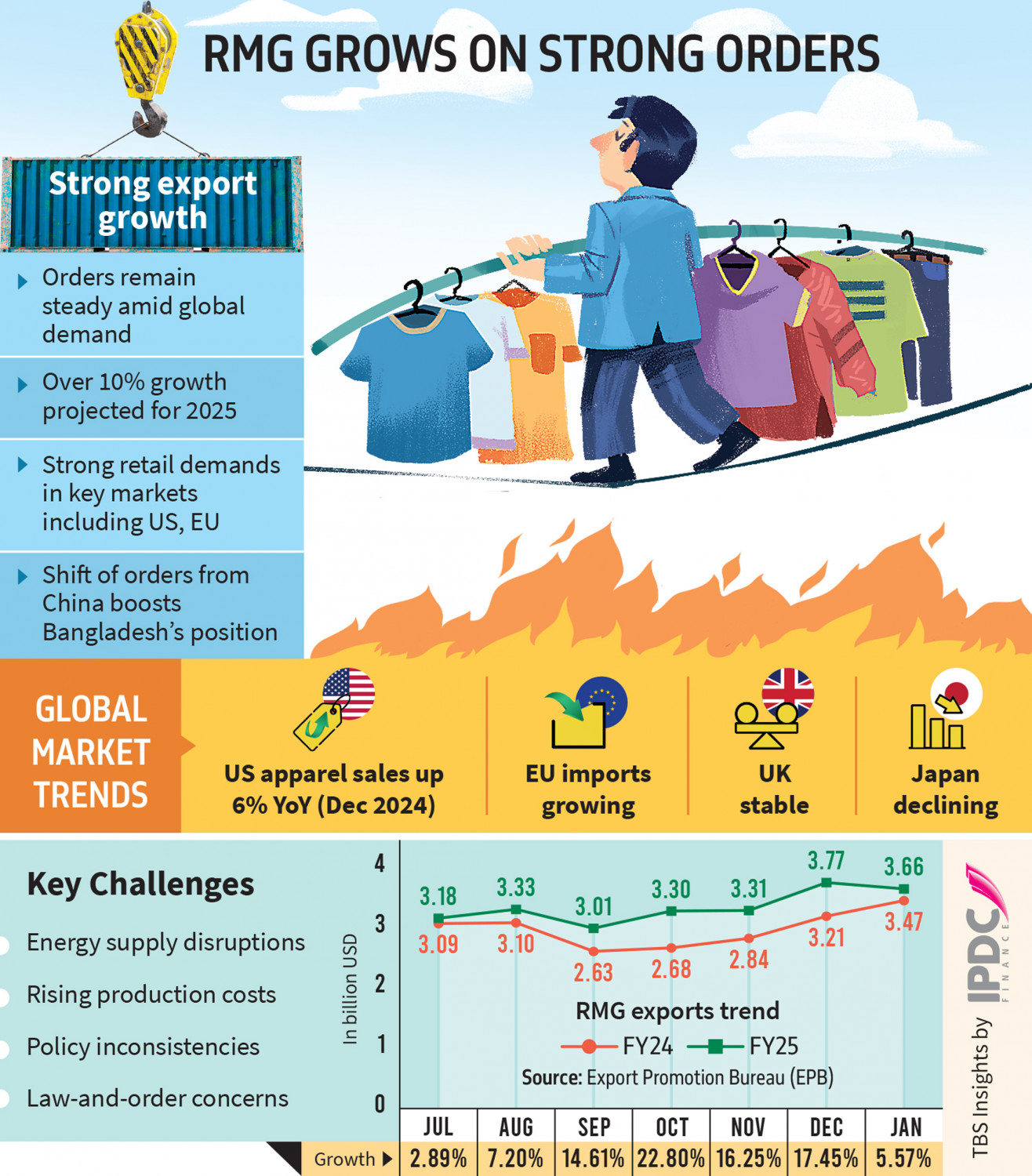

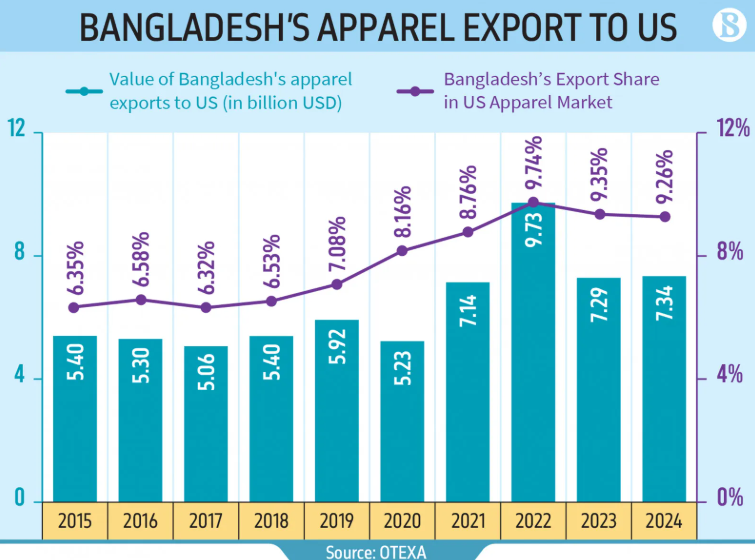

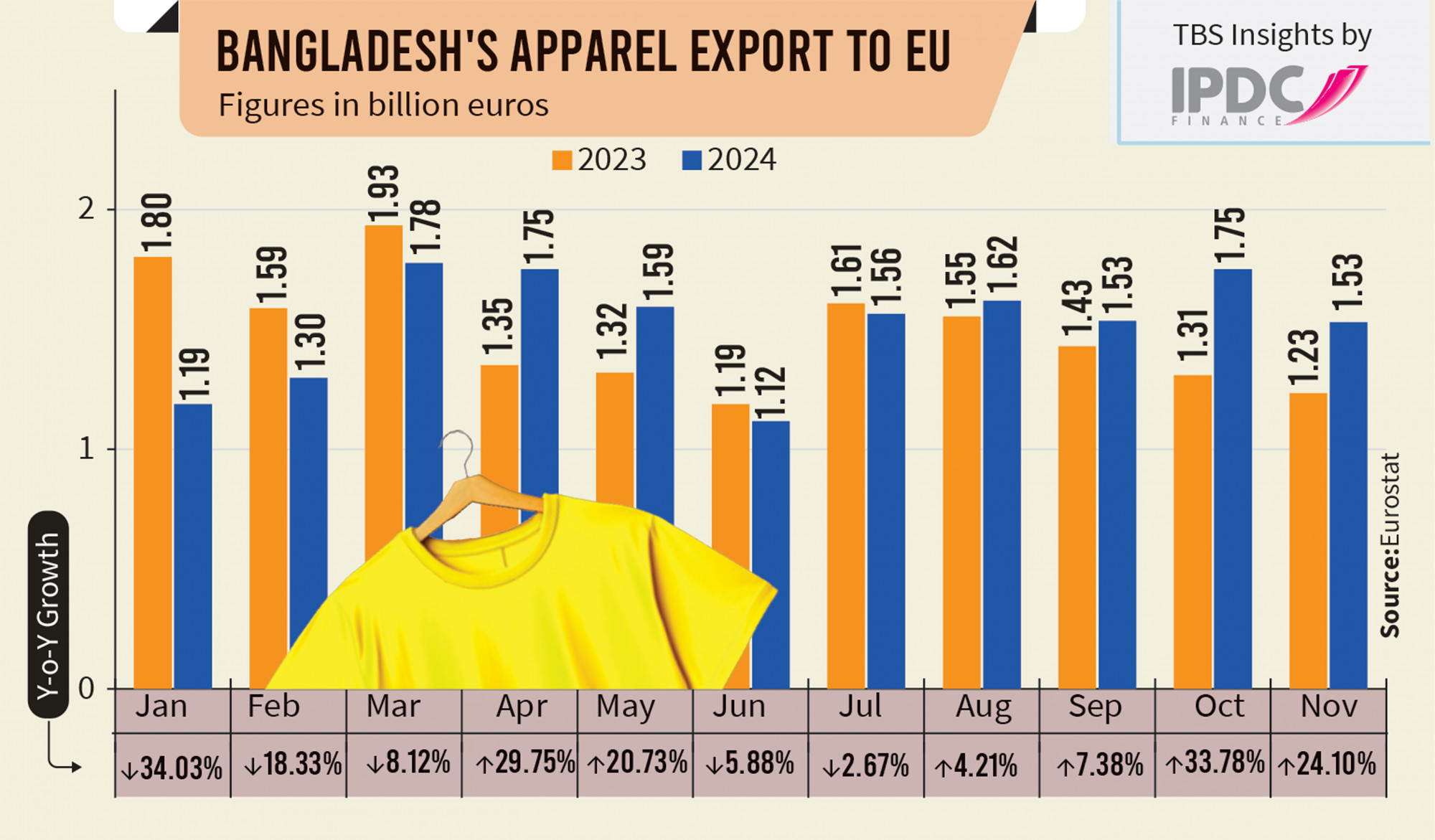

Over the past six months leading up to January 2025, Bangladesh’s readymade garment (RMG) industry has demonstrated remarkable resilience, securing robust export orders despite facing significant challenges. This success is largely attributed to increased demand from key markets such as the United States and the European Union, as well as a strategic shift of orders from China due to evolving global trade dynamics.

Sustained Growth Amidst Challenges

Industry leaders project a growth exceeding 10% in 2025, based on current order trajectories. Bangladeshi factories have carved a niche in producing high-demand outerwear, both knit and woven, which has bolstered their order books. This steady influx of orders is particularly noteworthy given the political upheaval following the student-led uprising on August 5, 2024, which led to the ousting of the previous government.

Adaptability and Commitment

The sector’s ability to adapt is exemplified by companies like Reza Group, which supplies fashion products to U.S. and European markets. Chairman AKM Shaheed Reza emphasized the industry’s resilience, stating that any operational disruptions are mitigated by extending work hours or adjusting schedules to meet commitments. This proactive approach ensures that buyers, whose representatives are well-acquainted with the Bangladeshi market, maintain their confidence in sourcing from the country.

Navigating Operational Hurdles

Despite the positive outlook, the industry remains cautious about potential challenges, including energy supply inconsistencies, rising operational costs, policy fluctuations, and law-and-order concerns. Certain buyers have expressed reservations about placing orders in specific zones like Ashulia, citing recent security issues and gas shortages that have impeded production capacities.

Mahmud Hassan Khan Babu, Managing Director of Rising Group, highlighted that while his company has secured orders up to June 2025, the fast fashion segment presents shorter lead times, with confirmations only until April. He also pointed out that unforeseen policy changes, such as hikes in utility costs or wages, could significantly impact businesses that plan operations months in advance.

Ensuring Energy Security

A consistent energy supply remains a critical concern. Vertically integrated factories, which rely heavily on uninterrupted gas supplies, face challenges that could compel them to source imported yarns and fabrics, potentially diminishing local value addition in the RMG sector. Ensuring a stable energy supply is paramount to maintaining production efficiency and competitiveness.

Optimistic Projections

Industry stakeholders express cautious optimism. Shams Mahmud, Managing Director of Shasha Denims, reported securing orders for the next four months but acknowledged that not all factories share this favorable position, especially those grappling with energy supply issues and financial constraints.

Similarly, Sheikh HM Mustafiz, CEO of Cute Dress Industries, anticipates a 15% growth in 2025, building on the company’s export figures of $7.3 million in the previous year. Giant Group’s Director, SM Majedur Rahim, noted full-capacity operations with order confirmations extending to July, with expectations of continued demand resurgence post the traditional lean period in August.

Bangladesh’s RMG industry continues to thrive, driven by strategic positioning, adaptability, and a steadfast commitment to meeting global demand, even in the face of political and operational challenges. Ongoing efforts to address energy and policy issues will be crucial in sustaining this growth trajectory in the coming years.

Source: